Bitcoin Magazine

If Institutions Are Buying Why Isn’t The Bitcoin Price Going Up?

ETF inflows and institutional purchases continue to climb, yet many investors are puzzled by the muted Bitcoin price action. With billions flowing into BTC, why aren’t we seeing the price explode to new highs? The reality is more nuanced than it first appears.

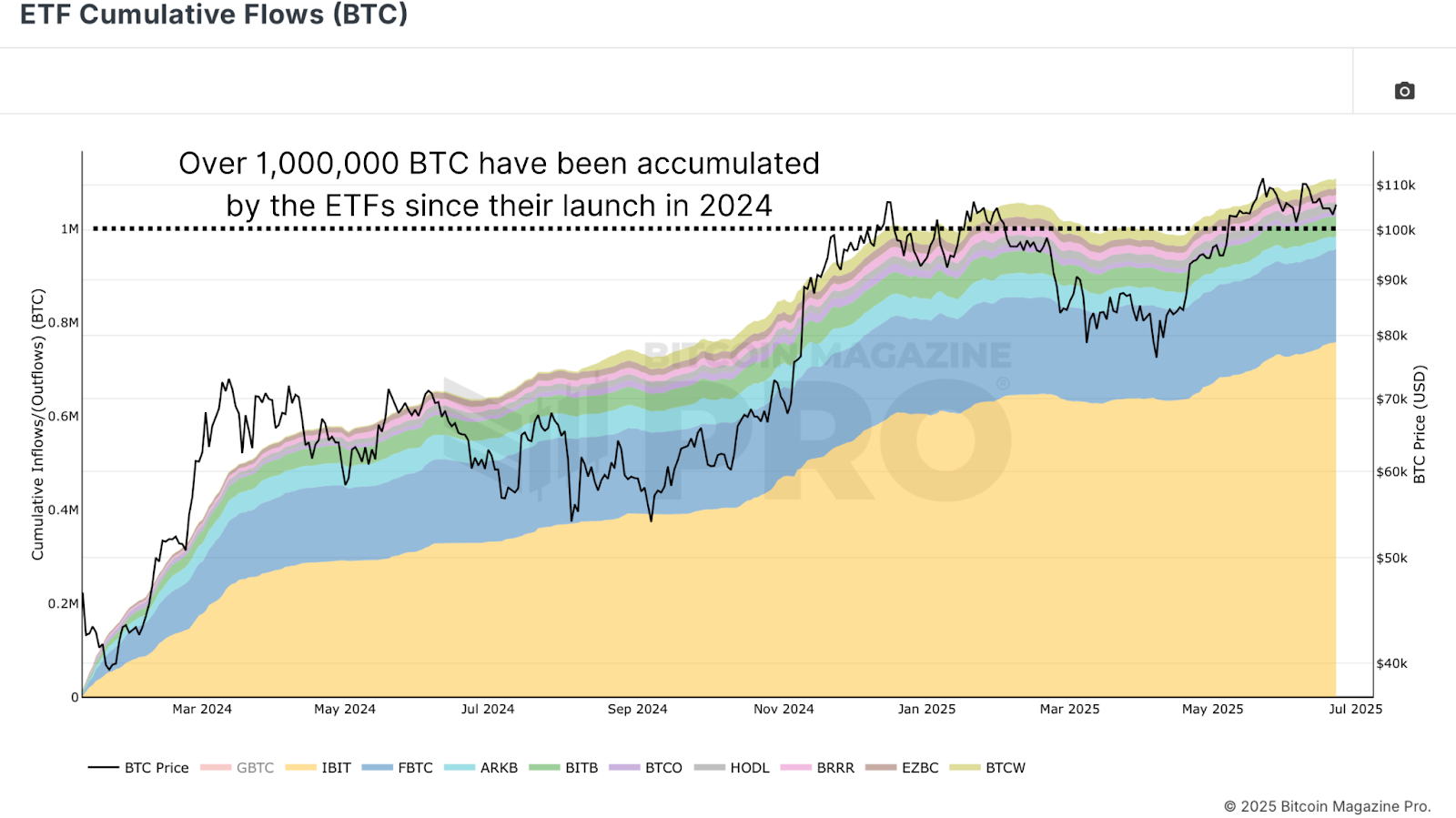

Bitcoin ETF Inflows

Looking at the ETF cumulative inflows chart (excluding GBTC outflows), it’s clear that demand from institutional players has been robust. Since the most recent pullback in late March, net ETF inflows have climbed from roughly 527,000 BTC to over 630,000 BTC, an increase of around 100,000 BTC in under 3 months. These are significant numbers, yet the Bitcoin price has largely mainly drifted sideways since the start of 2025.

It’s important to remember that not all ETF flows represent “institutional” buying in the purest sense. Many ETF purchases come from client allocations, for example, family offices or high-net-worth individuals using platforms like BlackRock. Still, these flows matter, and the steady accumulation is a positive driver for long-term supply and demand dynamics.

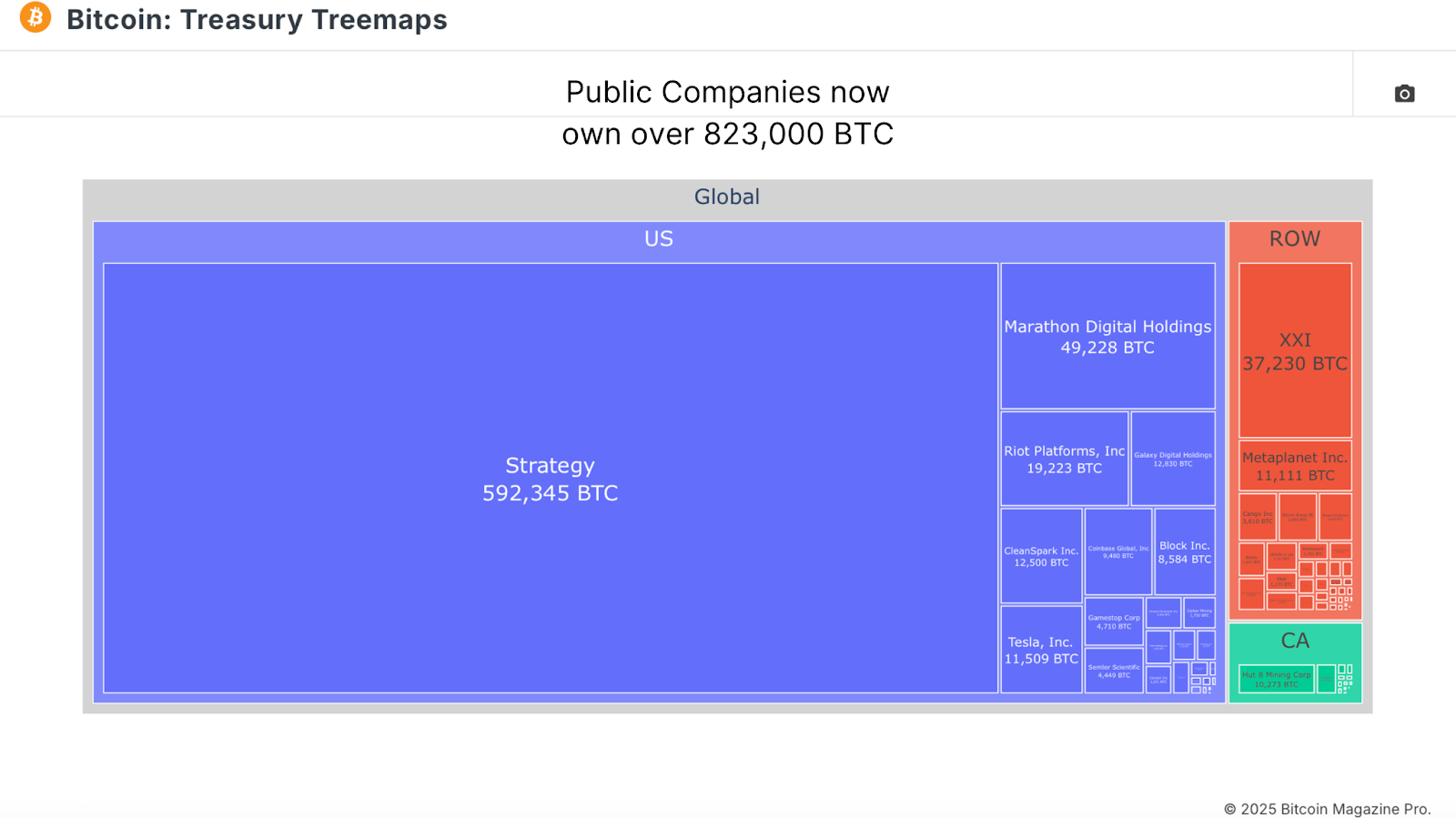

Bitcoin Treasury Buying

Complementing ETF inflows, corporate treasury buying has also been strong, with (Micro)Strategy leading the charge. MSTR alone have seen their holdings have jumped from roughly 528,000 BTC to over 592,000 BTC in this year alone. Across all treasury companies tracked, total holdings now exceed 823,000 BTC, representing an astounding $86 billion in value.

Despite this, many market participants feel underwhelmed by price action compared to prior cycles. But we must contextualize expectations: the BTC market cap is now in the multi-trillion-dollar range. The sheer scale of capital required to drive exponential moves today dwarfs previous cycles. Comparing this cycle to the 10x returns of earlier eras isn’t realistic. In truth, BTC has more than doubled from $40K at the time of ETF launch to recent levels above $110K, a still monumental achievement for a maturing asset class.

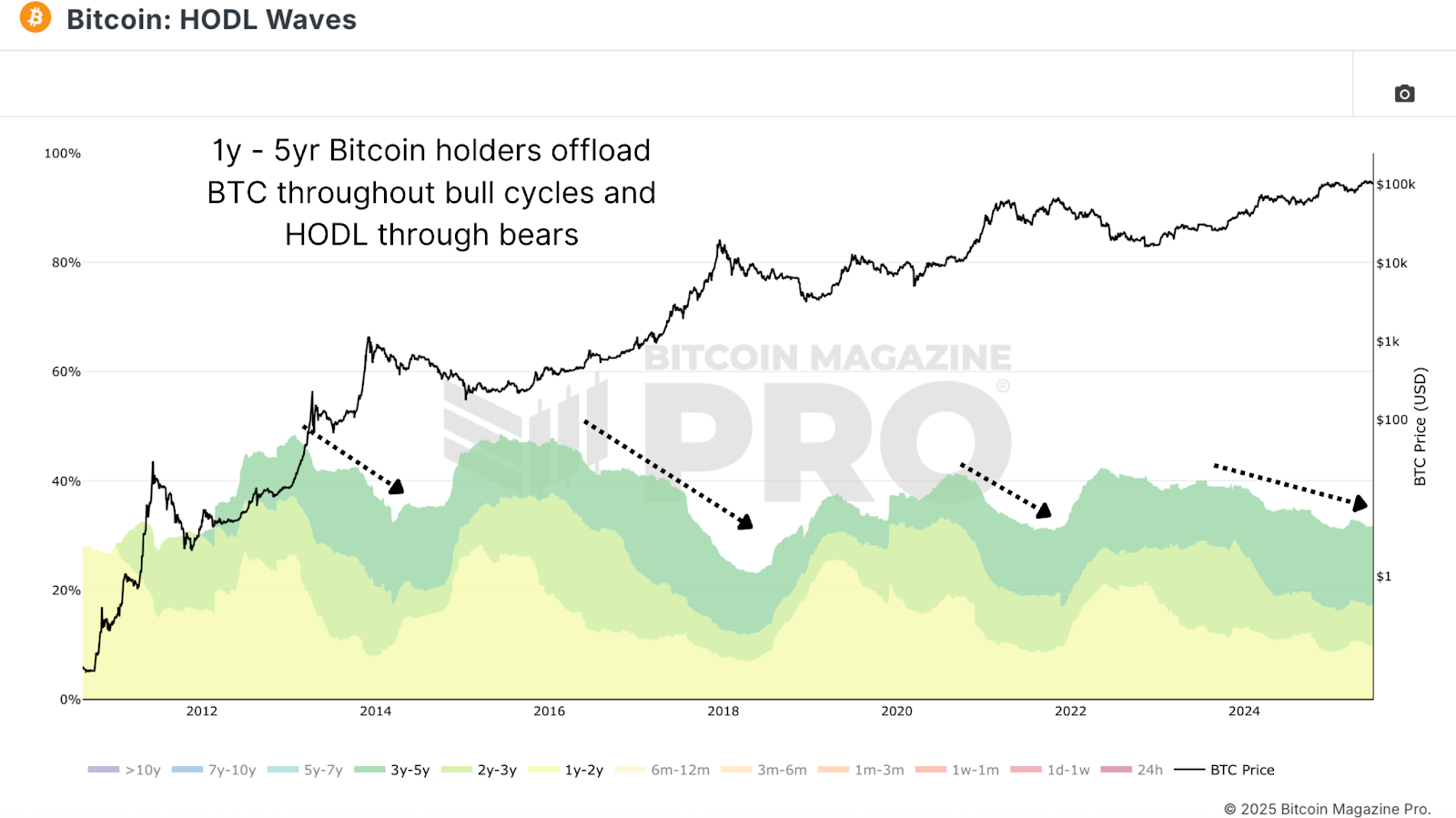

Bitcoin Supply Overhang

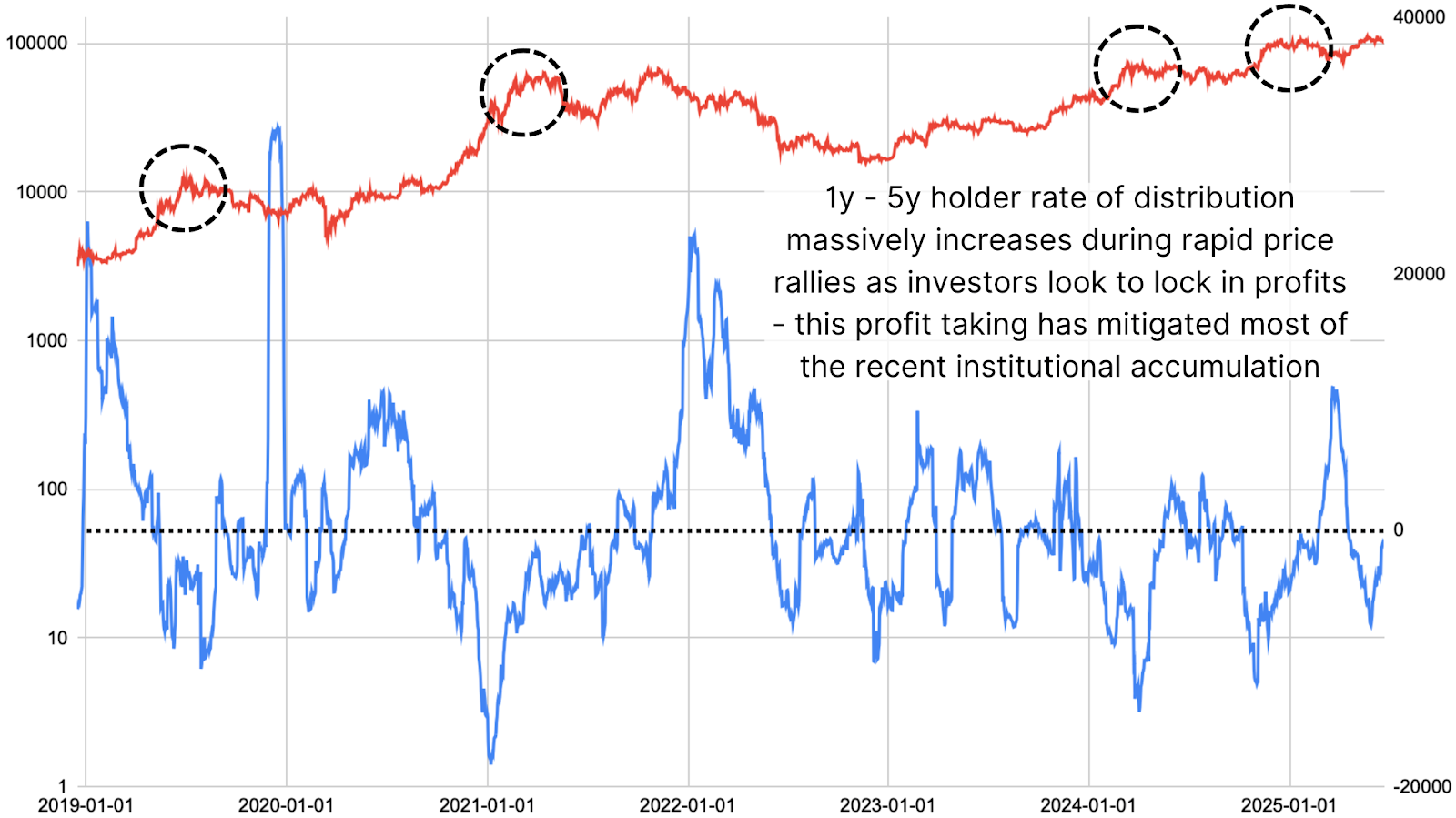

To understand why Bitcoin prices haven’t surged even further, we must examine selling behavior. By analyzing HODL Waves data for 1-5 year bands, we can quantify long-term holder profit-taking. Over the past three months, more than 240,000 BTC from these older bands has been distributed to the market, nearly a quarter-million BTC in net outflows.

This selling has largely counterbalanced institutional accumulation. Given that daily miner issuance still adds another ~450 BTC to the market, we see why price has struggled to break higher: the market is in a state of supply-demand equilibrium.

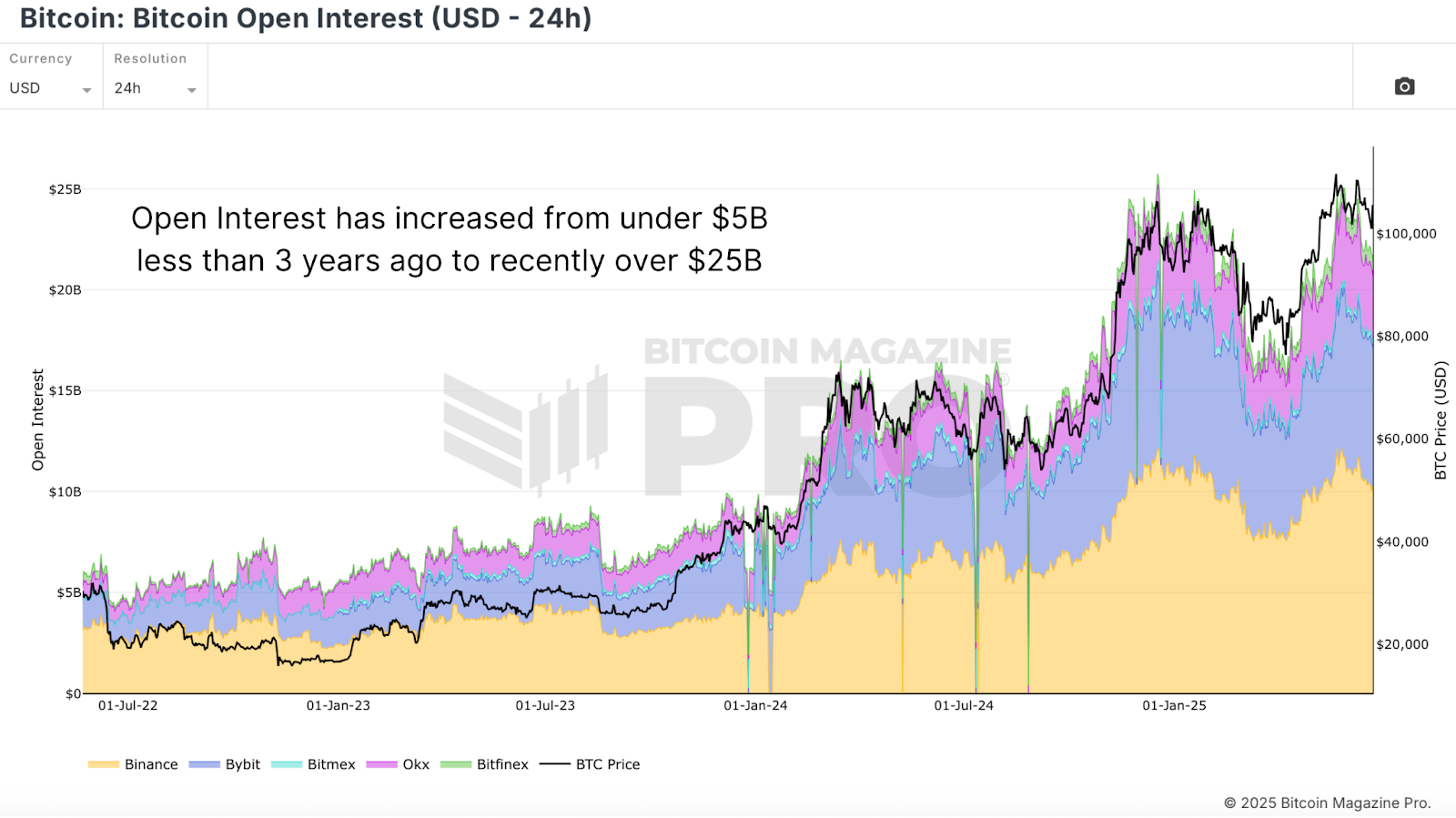

Meanwhile, open interest on BTC derivatives markets has exploded. From under $5B less than 3 years ago to over $25B today. Many new participants prefer are opting to trade “paper BTC” on derivatives rather than buying spot BTC, which reduces the positive influence on price of increased market participants.

Bitcoin Bullish Shifts

There is however now reason for optimism. Long-term holder selling is now decelerating, with recent net outflows falling below 1,000 BTC per day, a substantial reduction from previous monthly averages just weeks ago. If institutional inflows remain steady and retail demand starts to awaken, even at levels seen earlier this cycle rather than extreme prior peaks, we could easily see another powerful leg higher. Past instances show that when retail flows surge from these levels, BTC can double in price within months.

Conclusion

ETF inflows and treasury purchases are pouring billions of Dollars into Bitcoin, but the muted Bitcoin price reaction makes perfect sense when viewed through the lens of supply and demand. Heavy profit-taking by long-term holders and growing derivatives speculation have balanced out the inflows.

As long-term selling subsides and institutional buying continues, the stage is being set for the next bullish impulse. Whether we see the euphoric retail mania of prior cycles remains to be seen, but even modest retail inflows combined with current institutional demand could drive prices sharply higher sooner rather than later.

For more deep-dive research, technical indicators, real-time market alerts, and access to a growing community of analysts, visit BitcoinMagazinePro.com.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

This post If Institutions Are Buying Why Isn’t The Bitcoin Price Going Up? first appeared on Bitcoin Magazine and is written by Matt Crosby.