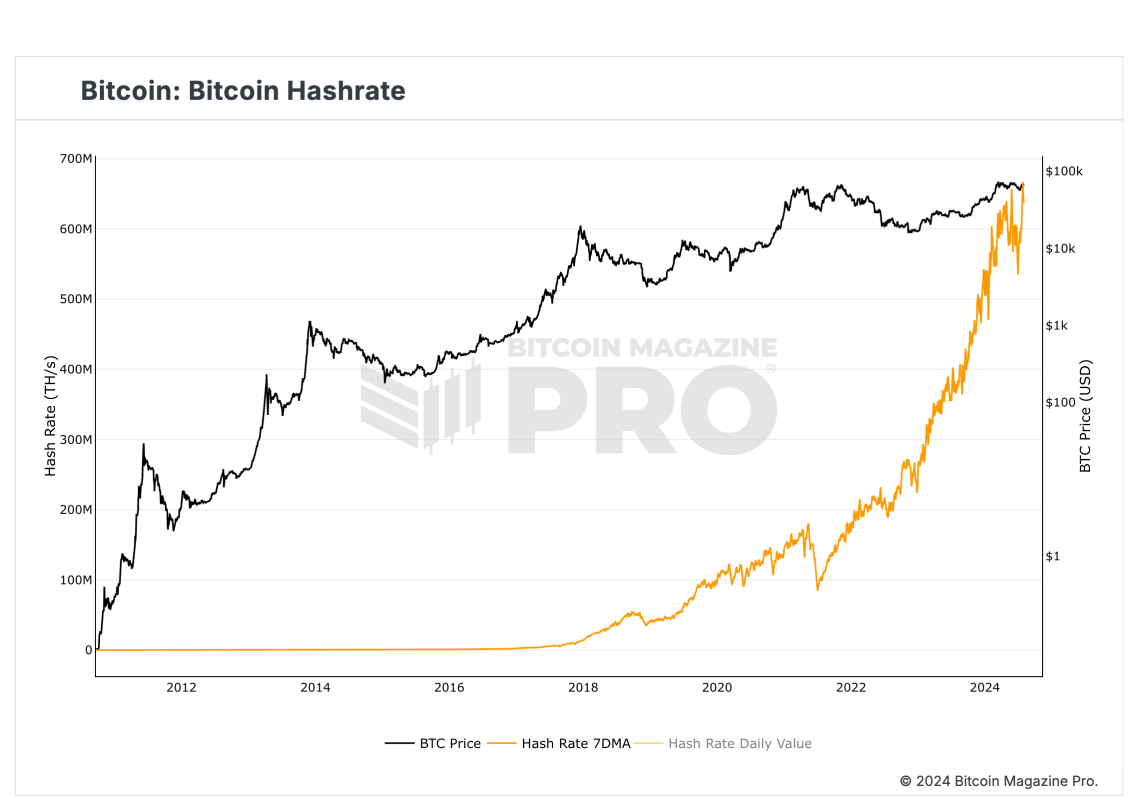

According to Bitcoin Magazine Pro, the 7-day average mining hash rate for Bitcoin has hit a new all-time high, surpassing 667 exahashes per second (EH/s) on July 26th during the Bitcoin 2024 conference. This tops the previous record of 657 EH/s set on May 26th.

The hash rate refers to the total computational power miners dedicate to processing transactions and mining new blocks on the Bitcoin blockchain. A higher hash rate means greater competition among miners to validate blocks, making the network more resistant to manipulation or attack.

Major mining firms like Whatsminer and MicroBT are rolling out new powerful machines to capitalize on the hash rate boom. Whatsminer unveiled four new mining rigs and an upcoming solar mining container system. MicroBT introduced its M6XS+ miners, which can handle 190 to 450 terahash.

Riot Platforms also acquired Block Mining for $92.5 million to expand its hash rate and market reach. Miners are exploring AI integration and acquisition opportunities to navigate ongoing identity challenges.

The boost in miners’ revenue from Bitcoin’s rising price has cooled selling pressure and stabilized network activity. Outflows from miners remained under $10,000 per day in July compared to over $20,000 in March when BTC first hit $70,000.

Overall, Bitcoin’s climbing hashrate reflects a vote of confidence in its long-term viability. With major mining innovations and favourable politics boosting revenues, miners are aggressively expanding infrastructure to process transactions and secure the Bitcoin network.