Bitcoin Magazine

Bitcoin Price Briefly Pumps Above $89,000 As Cooler CPI Data Rolls In

Bitcoin briefly surged above $89,000 on Thursday as a sharply cooler-than-expected U.S. inflation report came in.

At the time of writing, the bitcoin price was trading near $88,374, down roughly 2% over the past 24 hours, according to market data. The pullback leaves BTC about 2% below its recent seven-day high of $90,165 and roughly 4% above its week’s low near $85,374. Bitcoin’s market capitalization stands at approximately $1.77 trillion, with 19.96 million BTC currently in circulation.

The initial rally was sparked by fresh Consumer Price Index (CPI) data from the U.S. Bureau of Labor Statistics, which showed inflation cooling faster than economists expected. Headline CPI rose 2.7% year over year in November, well below consensus expectations of around 3% and down from earlier readings. Core CPI, which strips out food and energy, fell to 2.6%—its lowest level since early 2021.

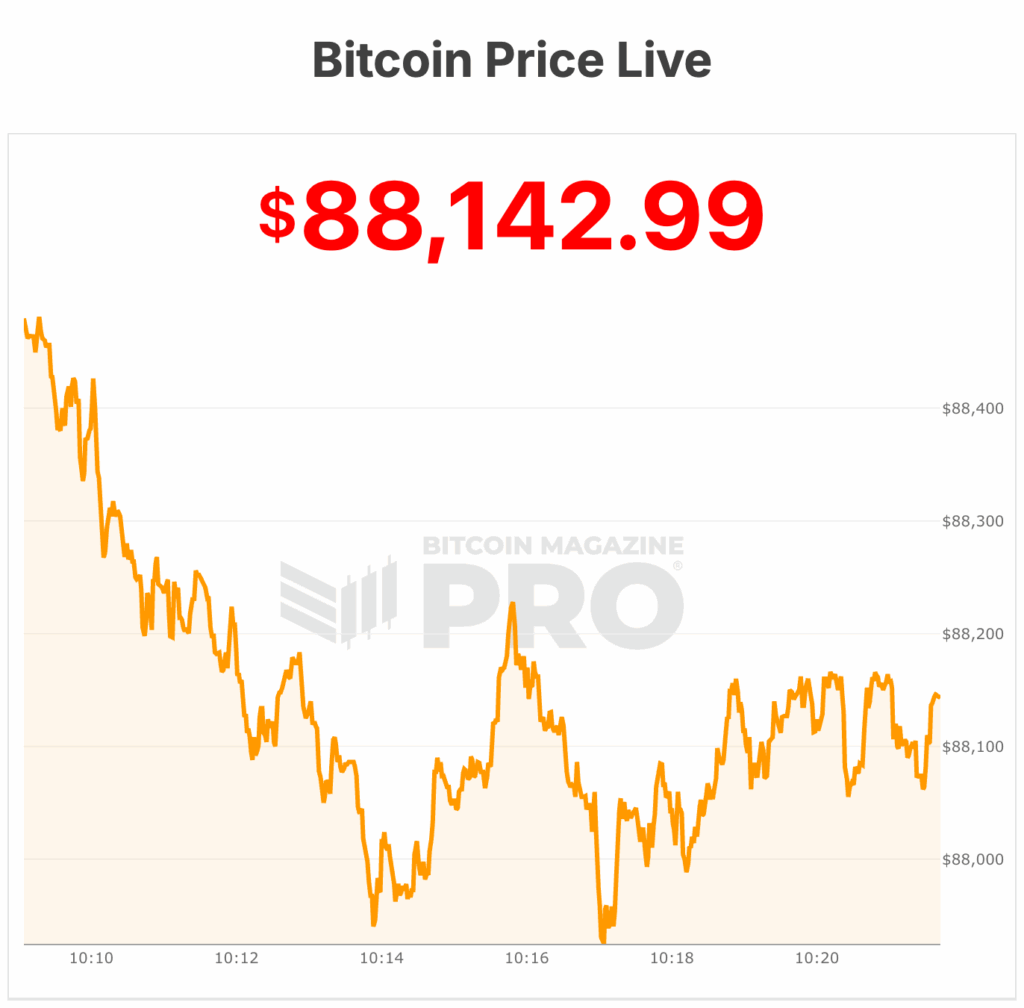

The bitcoin price reacted swiftly around the time of the data, jumping from intraday lows near $86,000 to briefly challenge the psychologically important $89,000 level, according to Bitcoin Magazine pro data.

The move reflected renewed optimism that easing inflation could give the Federal Reserve greater room to cut interest rates in 2026, a backdrop that has historically supported risk assets, including bitcoin.

According to CME FedWatch data, odds of a rate cut by March edged higher following the release, though expectations for a January move remain muted.

Bitcoin price action

Still, the rally proved short-lived. The bitcoin price failed to reclaim $90,000 decisively and slipped back as the session wore on, currently sitting near $88,000. This has been a market dynamic that has become familiar in recent weeks: sharp, data-driven bursts higher followed by rapid retracements.

One key headwind remains sustained outflows from the U.S.-listed spot bitcoin exchange-traded funds. After serving as a major source of demand earlier in the year, ETFs have seen steady net redemptions, removing a layer of institutional support that previously helped absorb selling pressure. Market participants say the absence of consistent ETF inflows has made it harder for bitcoin to sustain breakouts, even on positive macro news.

Macro signals remain mixed beyond inflation. Earlier this week, delayed U.S. labor market data showed unemployment rising to 4.6%, its highest level since 2021, while job growth remained uneven. The data complicates the Federal Reserve’s outlook, reinforcing expectations that policymakers will proceed cautiously despite cooling inflation.

Political uncertainty is also lingering in the background. President Donald Trump has publicly called for significantly lower interest rates and indicated he plans to nominate a Federal Reserve chair who supports more aggressive easing. While markets have so far treated the comments as noise, they add another variable to an already complex policy landscape.

Zooming out, bitcoin’s price appears to be consolidating rather than trending. Despite remaining near record highs on a historical basis, price action has tightened, with resistance forming just below $90,000 and strong supply reported above that level from investors who accumulated during earlier rallies.

Analysts at Bitwise recently released a report suggesting Bitcoin could break away from its historical four-year market cycle, potentially achieving new all-time highs in 2026 while exhibiting lower volatility and reduced correlation with equities.

The Bitwise report argues that the Bitcoin price’s historical four-year cycle, tied to halvings and marked by gains followed by pullbacks, may no longer hold. The firm also challenged the long-standing criticism that BTC is too volatile for mainstream investors.

According to Bitwise, BTC was less volatile than Nvidia stock throughout 2025, a comparison Hougan says underscores the asset’s ongoing maturation.

Market in ‘extreme fear’

At the time of writing, the Bitcoin Fear and Greed Index sits at 17/100, signaling extreme fear among market participants. Historically, readings in this range have often coincided with undervalued market conditions, suggesting a contrarian buying opportunity for those willing to navigate the emotional volatility.

Two days ago, the market sat near 11/100 despite a higher bitcoin price point.

For now, bitcoin’s response to softer inflation highlights its continued sensitivity to macroeconomic data, but the inability to sustain gains above $89,000 suggests conviction remains limited. At the time of writing, the bitcoin price is $88,142.

This post Bitcoin Price Briefly Pumps Above $89,000 As Cooler CPI Data Rolls In first appeared on Bitcoin Magazine and is written by Micah Zimmerman.