Bitcoin Magazine

Parabolic Bitcoin Rally Is Coming—Here’s What to Watch

One of the dominant narratives this cycle has been that “this time is different.” With institutional adoption reshaping Bitcoin’s supply and demand dynamics, many argue that we won’t see the kind of euphoric blowoff top that defined past cycles. Instead, the idea is that smart money and ETFs will smooth out volatility, replacing mania with maturity. But is that really the case?

Sentiment Drives Markets, Even for Institutions

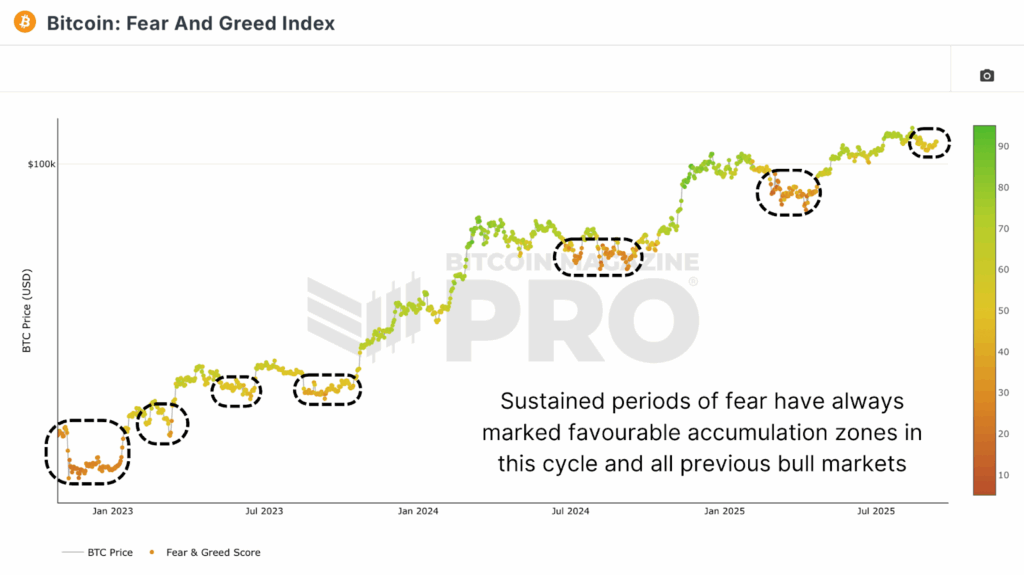

Skeptics often dismiss tools like the Fear and Greed Index as too simplistic, arguing that they can’t capture the nuance of institutional flows. But writing off sentiment ignores a fundamental truth that institutions are still run by people, and people remain prone to the same cognitive and emotional biases that drive market cycles, regardless of how deep their pockets are!

Even though volatility has dampened compared to earlier cycles, the move from $15,000 to over $120,000 is far from underwhelming. And crucially, Bitcoin has achieved this without the kind of deep, extended drawdowns that marked past bull markets. The ETF boom and corporate treasury accumulation have shifted supply dynamics, but the basic feedback loop of greed, fear, and speculation remains intact.

Market Bubbles Are a Timeless Reality

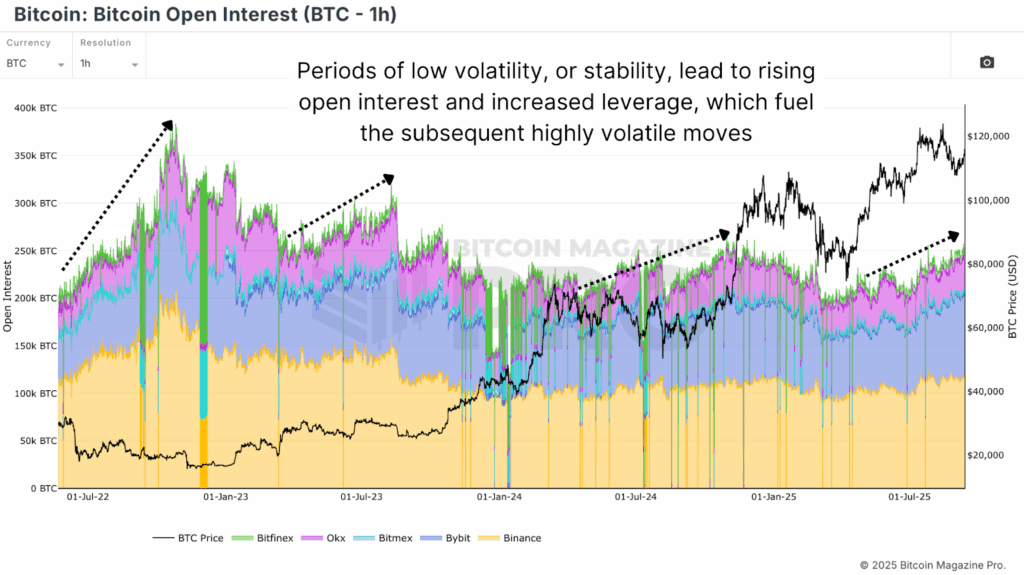

It’s not just Bitcoin that’s susceptible to parabolic runs, bubbles have been part of markets for centuries. Asset prices have repeatedly surged beyond fundamentals, fueled by human behavior. Studies consistently show that stability itself often breeds instability, and that quiet periods encourage leverage, speculation, and eventually runaway price action. Bitcoin has followed this same rhythm. Periods of low volatility see Open Interest climb, leverage build, and speculative bets increase.

Contrary to the belief that “sophisticated” investors are immune, research from the London School of Economics suggests the opposite. Professional capital can accelerate bubbles by piling in late, chasing momentum, and amplifying moves. The 2008 housing crisis and the dot-com bust were not retail-driven, but led by institutions.

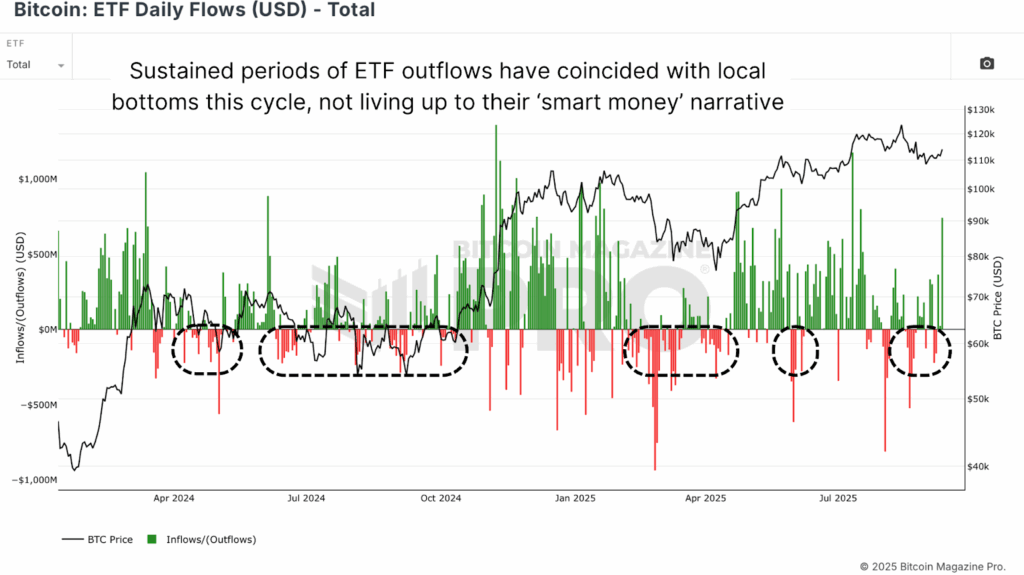

ETF flows this cycle provide another powerful example. Periods of net outflows from spot ETFs have actually coincided with local market bottoms. Rather than perfectly timing the cycle, these flows reveal that “smart money” is just as prone to herd behavior and trend following investing as retail traders.

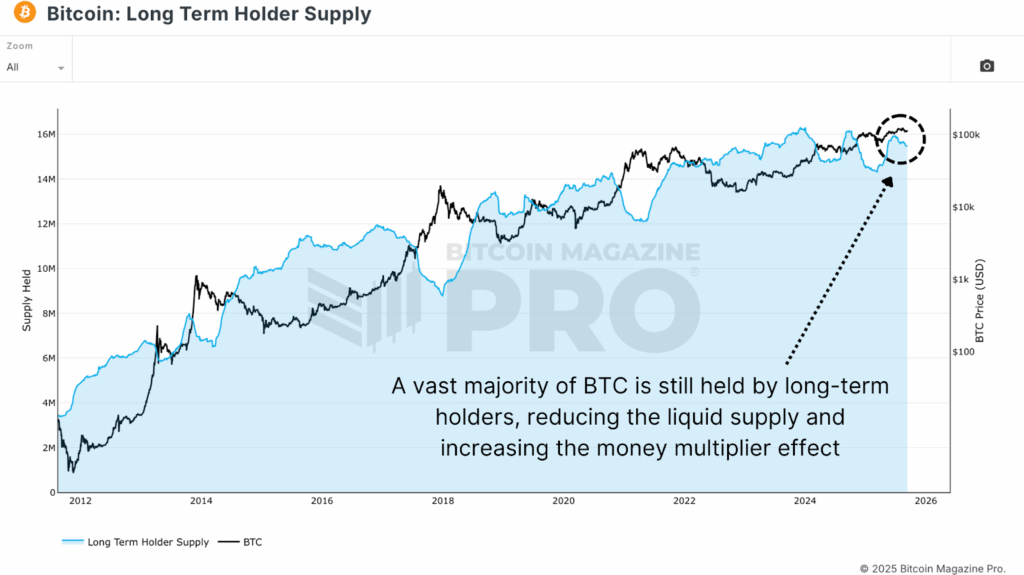

Capital Flows Could Ignite Bitcoin’s Next Leap

Meanwhile, looking at global markets shows how capital rotation could ignite another parabolic leg. Since January 2024, Gold’s market cap has surged by over $10 trillion, from $14T to $24T. For Bitcoin, with a current market cap around $2T, even a fraction of that kind of inflow could have an outsized effect thanks to the money multiplier. With roughly 77% of BTC held by long-term holders, only about 20–25% of supply is readily liquid, resulting in a conservative money multiplier of 4x. That means new inflows of $500 billion, just 5% of gold’s recent expansion, could translate into a $2 trillion increase in Bitcoin’s market cap, implying prices well over $220,000.

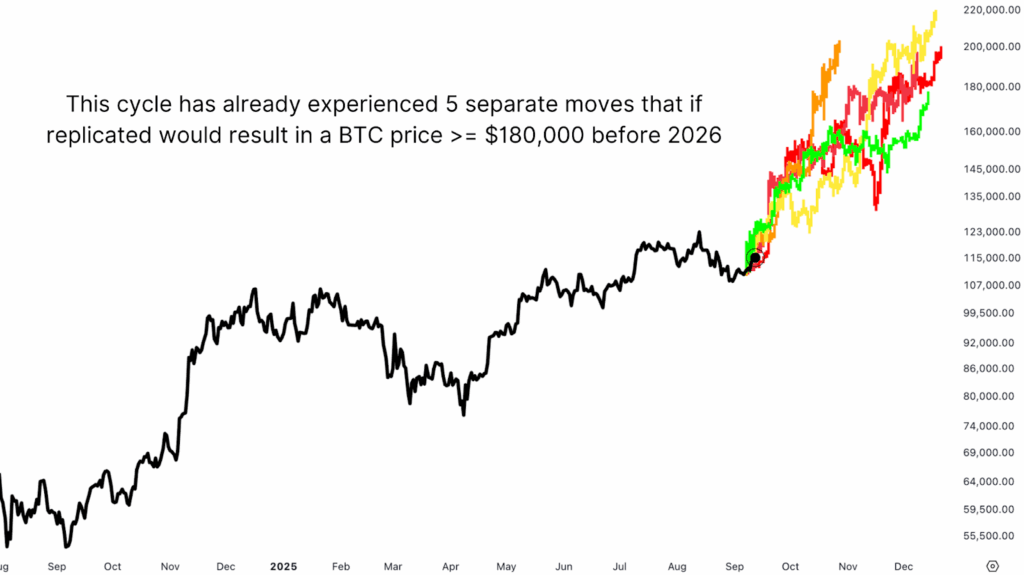

Perhaps the strongest case for a blowoff top is that we’ve already seen parabolic rallies within this very cycle. Since the 2022 bottom, Bitcoin has staged multiple 60–100%+ runs in under 100 days. Overlaying those fractals onto current price action provides realistic outlines of how price could reach $180,000–$220,000 before year-end.

Bitcoin’s Parabolic Potential Remains Unshaken

The narrative that institutional adoption has eliminated parabolic blowoff tops underestimates both Bitcoin’s structure and human psychology. Bubbles aren’t an accident of retail speculation; they are a recurring feature of markets across history, often accelerated by sophisticated capital.

This doesn’t mean certainty, markets never work that way. But dismissing the possibility of a parabolic top ignores centuries of market behavior and the unique supply-demand mechanics that make Bitcoin one of the most reflexive assets in history. If anything, “this time is different” may only mean that the rally could be bigger, faster, and more dramatic than most expect.

For deeper data, charts, and professional insights into bitcoin price trends, visit BitcoinMagazinePro.com.

Subscribe to Bitcoin Magazine Pro on YouTube for more expert market insights and analysis!

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

This post Parabolic Bitcoin Rally Is Coming—Here’s What to Watch first appeared on Bitcoin Magazine and is written by Matt Crosby.